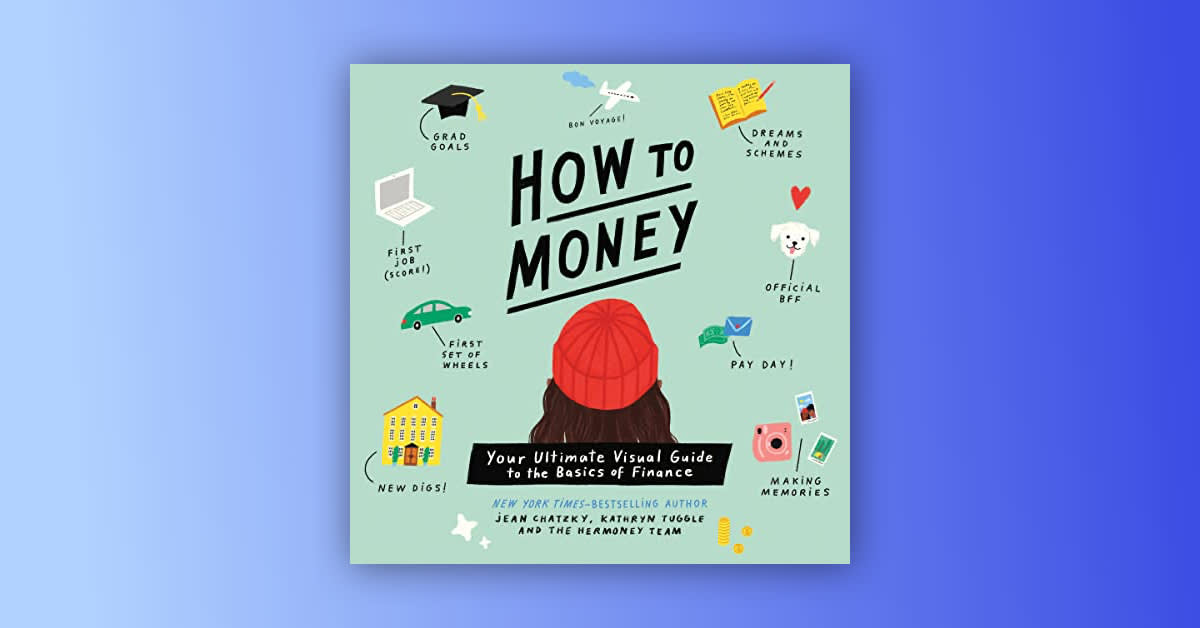

Financial experts Jean Chatzky and Kathryn Tuggle pair up with the rest of the HerMoney team to share the basics of financial advice with young adults in their new audiobook, How to Money: Your Ultimate Visual Guide to the Basics of Finance. Here, they share why everyone between the ages of 16 and 21 should download a copy—and how to avoid the #1 mistake people make when building their budget.

Who is How to Money written for?

How to Money was written for young people aged 16 to 21 who are just starting their financial lives and taking their first steps toward independence. But truthfully, our book is for anyone and everyone who wants a basic primer on their finances. We squire listeners through the basics of financial goal setting, budgeting, banking, choosing credit and debit cards, managing student loans and other debt, health insurance, salary negotiation, résumé writing, and so much more. If you’re ready to be fearless with your finances, this is the book for you.

(And we think Real Simple magazine might have said it best: “Where was this book when we were teenagers?”)

Why should listeners download How to Money?

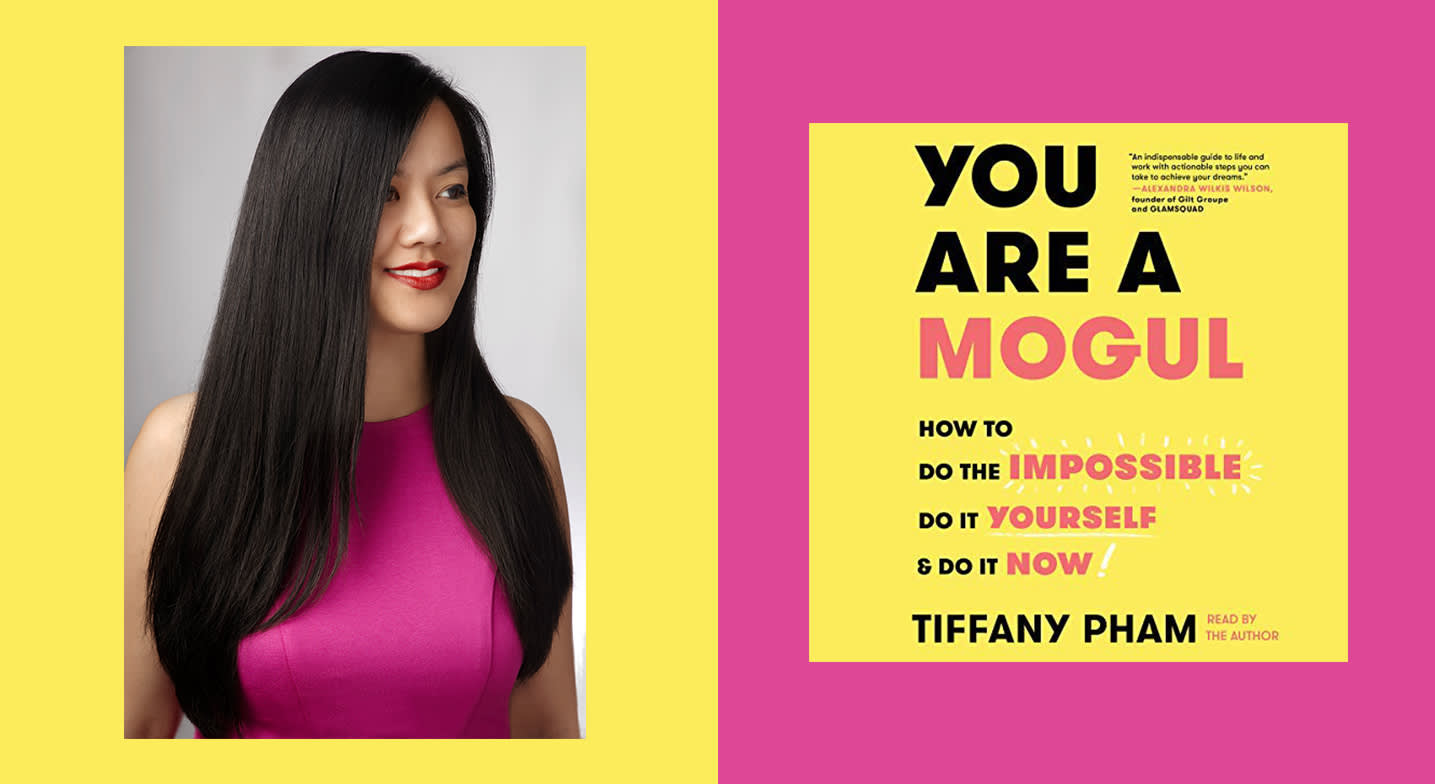

We know that people like to learn about money in different ways. If you’re the type who prefers to talk about your money rather than read about it, then the Audible version is for you. (Listening to our book is just like having a money conversation with your girlfriends.) And if you’re a fan of the HerMoney podcast, then it's also kind of like tuning in for an epic episode with Jean and Kathryn, plus a lot of great guests. We scored some pretty incredible narrators to lend their voices to the 13 female leaders we profiled.

What is the #1 mistake people make when creating a budget?

One of the biggest mistakes people make is not having an understanding of where their money is going. The first thing we recommend when getting started with a budget is to track your purchases for at least one week—preferably, one month—so you can see exactly how you typically spend and where you might be able to cut back in order to reach your bigger saving and investing goals. When you approach your budget like a living map of your financial life, with exciting milestones to hit along the way, the process can not only be stress free—it can even be fun.